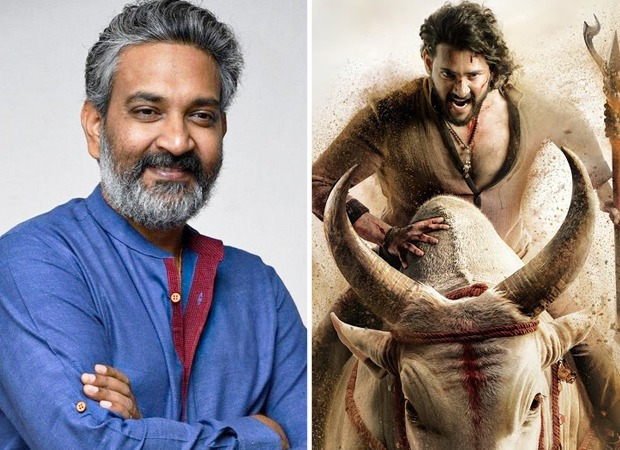

SS Rajamouli took the global audience by storm with the launch of his next directorial, Varanasi, starring Mahesh Babu, Priyanka Chopra, and Prithviraj in lead roles. The first teaser has become the talk of the town, and there is a demand to know more about the film from cine-goers all across the board. And now, we have an exclusive scoop on the budget of the film. Very reliable sources close to the project have confirmed that Varanasi will be made on a historic budget of Rs. 1300 crores, excluding the amount kept aside for print and publicity. “Rs. 1300 crore is a rather small amount to bring the mammoth vision of SS Rajamouli to the spectacle. While films like A6 and Ramayana are being made on a budget of Rs. 1500 crores to 2000 crores, SS Rajamouli is set to make a bigger looking film than the two on a much lower budget,” a trade source shared with Bollywood Hungama. We hear that SS Rajamouli has craftily designed some of the most epic sequences and is shooting for them in a planned manner. “Rajamouli is one of the most well-organised directors of Indian Cinema. He has designed all the moments on paper and is now merely executing them. He isn’t someone who wastes time and money by deciding things on the set. He has done the pre-viz, and then shooting, leading to the saving of money for the producers. However, the film will look bigger than any other film made in India.”The source also confirms that the Globetrotter event was one of the biggest events ever conducted in India, as SS Rajamouli and team spent Rs. 20 crores on the same. “Everything around the film will be the biggest ever. This is just the beginning.”Varanasi is set for a 2027 release. Also Read: Here’s the cost of SS Rajamouli’s Varanasi announcement event.