**Looking Ahead to 2026: Yat Siu’s Insights on the Future of Web3**

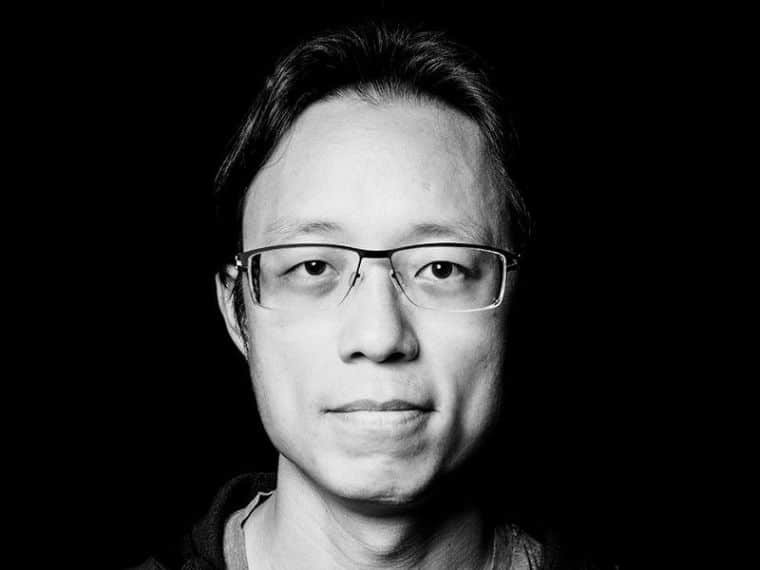

As the world prepares for the World Economic Forum 2026 (WEF) in Davos, Switzerland—a gathering of the most influential world leaders and CEOs—Yat Siu, co-founder and executive chairman of Animoca Brands, shares his perspective on what the new year could bring for the Web3 space. Here are his key thoughts.

—

### Is Bitcoin Still “The” Thing in Web3?

Bitcoin has solidified its status as “digital gold,” but it is the broader altcoin market that truly represents global innovation and utility within Web3.

Most newcomers to crypto enter through tokens offering tangible utility, such as those involved in DeFi, gaming, or NFTs. This dynamic can be likened to the relationship between gold and the stock market: no single company’s market cap rivals that of gold, yet collectively, the global stock market far exceeds gold in value.

The rapid growth of altcoins signals substantial opportunities not only in newly launched tokens but also in those already established. This trend resembles the post-dotcom era, when industry giants emerged stronger after the crash.

—

### What to Expect in 2026: Regulatory Developments

2025 saw important legislative advancements, and 2026 promises to build on this momentum with increased regulatory clarity triggering wider corporate adoption.

The US Genius Act laid the groundwork for stablecoins, while the proposed Clarity Act aims to delineate jurisdiction between the SEC and CFTC over digital assets. Yat Siu expects this Act to pass Congress in 2026, paving the way for a wave of tokenization across US companies—both large and small.

—

### Are Banks and Financial Institutions Still Interested in Web3?

Absolutely. Institutional adoption will drive the next growth phase.

Following the launch of crypto ETFs, financial institutions are now focusing on Real World Assets (RWAs) and stablecoins, which promise to democratize access to financial services. This will enable faster, more inclusive financial solutions—such as crypto wallets for the unbanked—aligning with crypto’s mission of financial inclusion.

—

### How are Investors Approaching Web3 in This New Era?

The funding cycle has evolved into one centered around liquid assets.

Investing in tokens already available on the market—with existing liquidity—is becoming the norm. This mirrors the post-dotcom crash investment patterns that saw companies like Amazon, Microsoft, Apple, and eBay grow substantially.

In addition to established Web3 leaders, expect the entry of major players akin to “the Googles and Facebooks” of the world. The opportunities in Web3 are no longer just about eagerly anticipated token launches; they now require sophisticated analysis.

Public investment vehicles, such as token funds, offer a strategic advantage by providing liquidity while maintaining exposure to long-term growth.

—

### Is Tokenization Still a Niche? What Are Its Most Promising Applications?

Currently, the most effective and perfect applications of tokenization lie in intellectual property, royalties, and advertising inventory.

Though tokenized RWAs remain fragmented across various chains and marketplaces, estimates suggest this market could reach up to US$30 trillion within the next decade. The adoption of compliant, institutional-grade tokenization frameworks—such as the EU’s MiCA regulation—makes RWAs highly attractive for banks and asset managers engaging with public blockchains.

Furthermore, crypto is rapidly becoming the asset class of younger generations, much like how they embraced the Internet and social media. Engaging this audience effectively will demand strategies incorporating tokenization.

—

### Is Web3 Ready for a Broader Audience?

Yes, but the transition will be subtle.

Web2 users will naturally become Web3 users as blockchain and crypto operate transparently in the background. Consider how “digital music” has simply become “music” today—soon, blockchain-powered features will be similarly invisible yet impactful.

Modern applications like prediction markets utilize crypto rails, but users care only about the service’s appeal, not the blockchain technology behind it.

This practical, behind-the-scenes integration of blockchain adds value across diverse services, such as gaming (with NFTs as in-game assets) and yield-generating products like RWAs and stablecoins.

Over time, as blockchain fades into the background, mainstream users will adopt crypto-based services driven purely by their utility—faster payments and digital ownership of virtual goods, for example.

—

### What Are the Main Themes for 2026?

In 2026, the focus in crypto will shift from crypto natives to the “crypto curious,” and from entertainment-driven projects to those emphasizing utility and value.

To date, many meme-coin launches have catered mostly to crypto insiders, leaving mainstream Web2 users uninterested. However, with more user-friendly regulatory frameworks emerging worldwide—including the anticipated passage of the Clarity Act in the US—tokens can more openly express their value propositions.

This will allow a clearer distinction between tokens designed for entertainment and those offering genuine utility. Tokens lacking real value (such as traditional meme-coins) are expected to wane, while utility-focused tokens will gain prominence.

—

### A Final Word for Web3 Aspirants: Financial Literacy is King

Crypto adoption is already addressing financial inefficiencies—lowering remittance costs, enabling participation in fast-growing markets, and improving yield generation—and will deepen its roots in everyday financial services.

Expect crypto to increasingly impact broader financial sectors such as student and consumer loans, and eventually unsecured credit.

Just as businesses had to become digitally literate from the 1990s onward, consumers must now become financially literate to fully leverage tokenization and financialization.

In essence, “tokenize or die”: companies that fail to tokenize their assets to harness AI and Web3 liquidity risk becoming obsolete, much like traditional businesses that lost out to Internet-savvy competitors such as Amazon or Steam.

—

*Yat Siu’s outlook underscores a transformative year ahead for Web3—one marked by growing adoption, regulatory clarity, financial inclusion, and a maturing investment landscape centered on real value and utility.*

https://ceoworld.biz/2026/01/12/yat-sius-web3-market-outlook-for-2026/