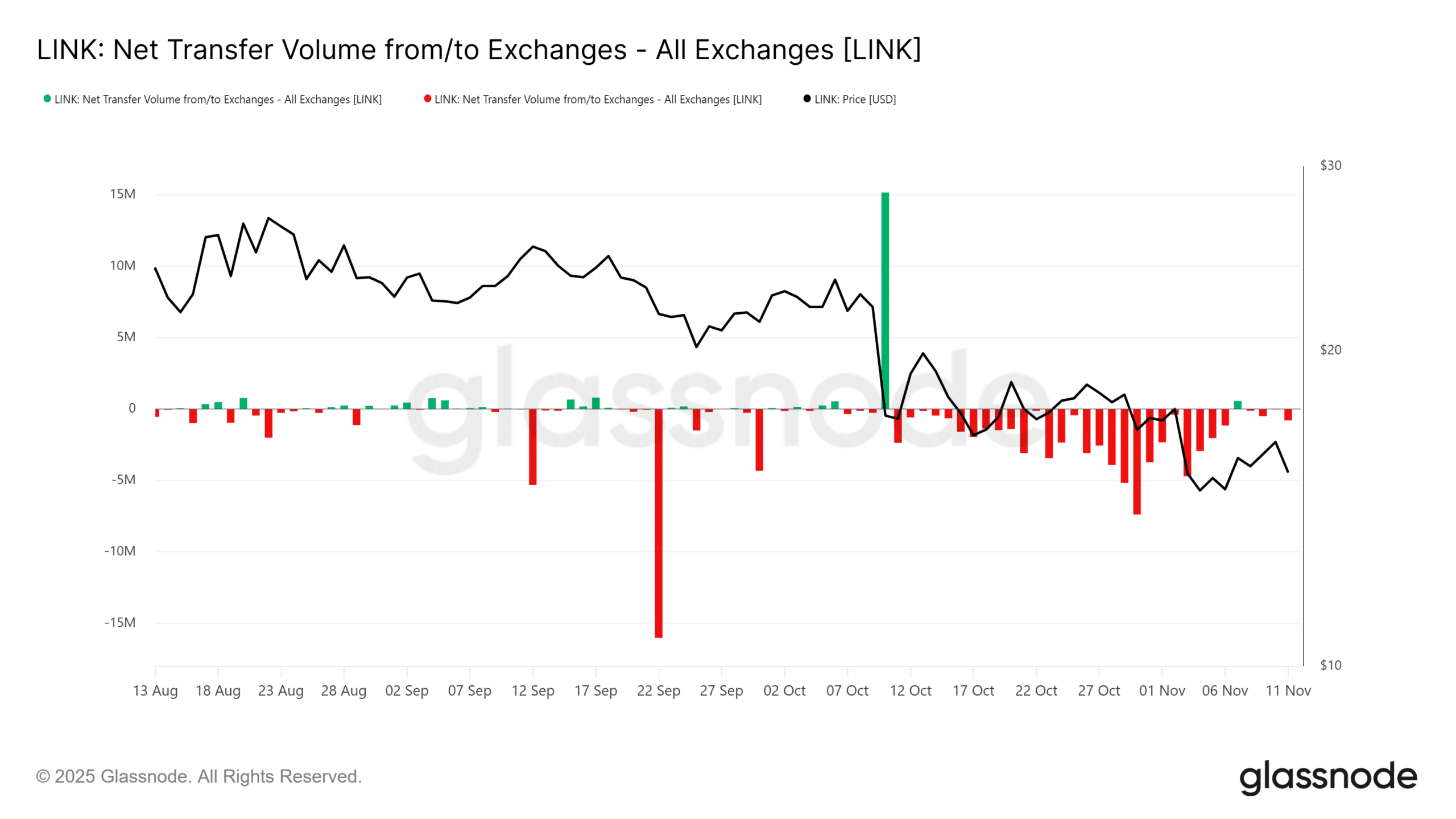

The post Chainlink’s 63 Millicom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Over 63 million Chainlink (LINK) tokens were withdrawn from exchanges in the past month, signaling accumulation and rising demand amid a 30% price decline since early October. This on-chain activity contrasts with bearish price trends, highlighting potential long-term bullish interest despite short-term profit-taking. Chainlink LINK tokens withdrawal indicates strong holder accumulation, reducing available supply on exchanges. Positive social sentiment and high engagement underscore growing interest in Chainlink’s oracle network. LINK price fell 30. 1% from $22. 58 to $15. 77 since October, with a recent 15% bounce facing selling pressure, per Glassnode data. Discover the implications of 63 million Chainlink LINK tokens withdrawal from exchanges. Explore accumulation signals, price analysis, and recovery outlook in this detailed report. Stay informed on crypto trends today. What does the recent Chainlink LINK tokens withdrawal from exchanges signify? Chainlink LINK tokens withdrawal from exchanges, totaling over 63 million tokens in the past month, points to significant accumulation by holders, a classic sign of increasing demand and confidence in the network’s future. This movement reduces circulating supply on trading platforms, potentially supporting price stability over time. Despite.