**Chainlink LINK Tokens Withdrawal Signals Strong Accumulation Amid Price Volatility**

Recent on-chain data reveals a significant withdrawal of over 63 million Chainlink (LINK) tokens from exchanges within the past month, indicating strong accumulation by holders. This shift reduces the available supply of LINK on trading platforms and suggests growing confidence in the network’s future prospects.

—

### What Does the Withdrawal of 63 Million LINK Tokens Mean?

The large-scale withdrawal of LINK tokens from exchanges typically reflects long-term holding behavior, as investors move assets to personal wallets to reduce sell-side pressure. Such accumulation is often interpreted as a bullish sign, highlighting increasing demand and confidence in Chainlink’s utility.

Despite this, LINK’s price has experienced a notable decline of 30.1% since early October, dropping from $22.58 to $15.77, according to crypto analyst Ali Martinez. This price drop contrasts with the accumulation activity and points toward underlying market challenges.

—

### Impact of On-Chain Activity on Chainlink’s Market Performance

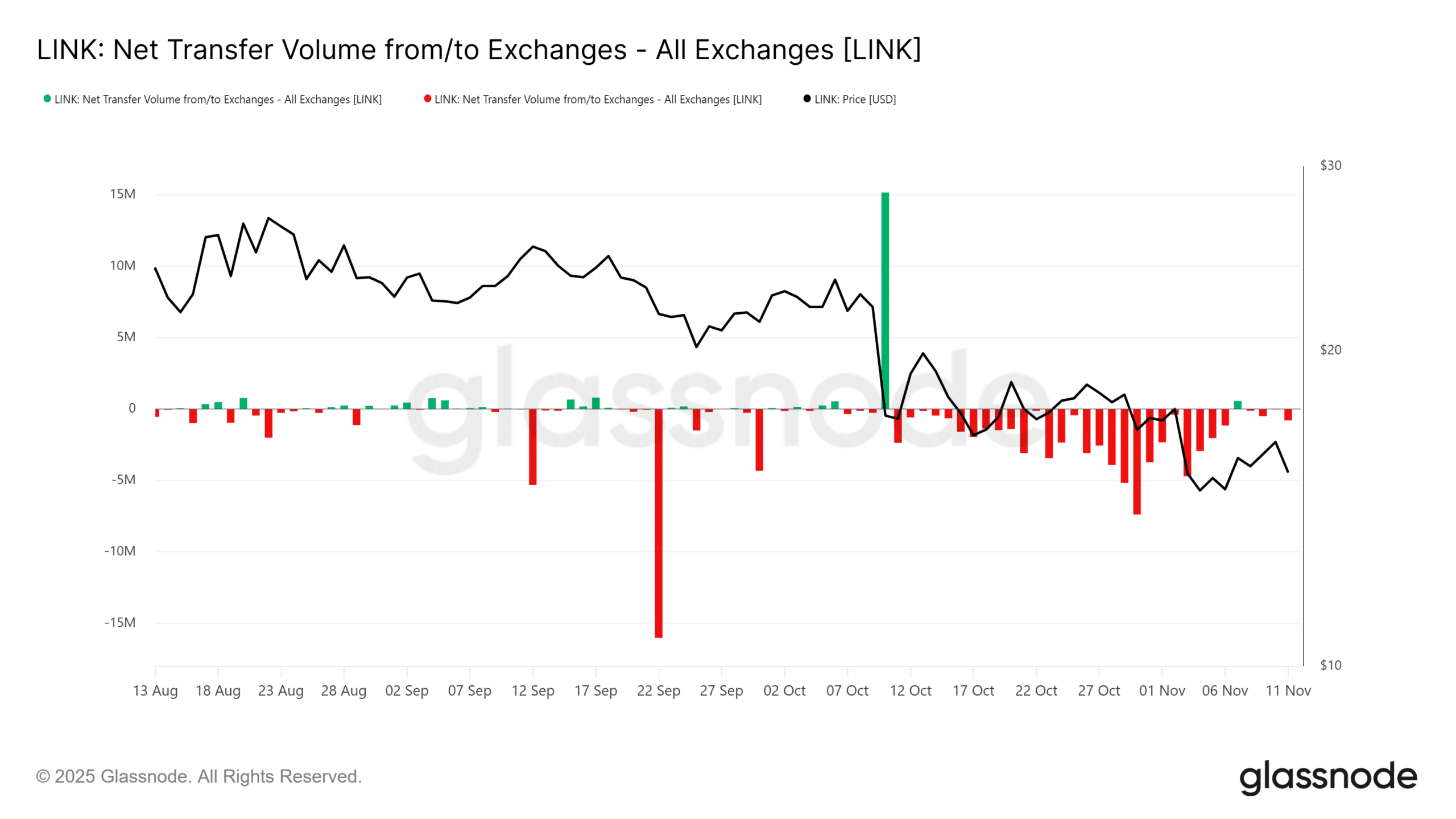

Chainlink’s withdrawal trend aligns with broader accumulation patterns. Glassnode data shows that demand has remained strong amid elevated social engagement and positive weighted sentiment across the Chainlink community.

Additionally, the Chainlink Reserve has grown by 78,000 LINK tokens, further bolstering the network’s operational reserves. These developments underscore the project’s expanding foundation and growing investor confidence.

However, on-chain metrics also reveal ongoing obstacles. The net transfer volume—the difference between LINK moving into and out of exchanges—remained negative for most of the month, indicating that outflows dominated until a recent short-term price bounce.

Around November 10, LINK’s price rallied nearly 15%, rising from $14.40 to $16.65. During this period, net transfers shifted toward neutral, but exchange inflows increased, suggesting that some holders took profits. Supporting this, the Coin Days Destroyed metric peaked on the same date, signaling that long-held tokens were actively moved for selling.

—

### Market Sentiment and Price Analysis

Chainlink continues to expand its ecosystem through partnerships with major financial institutions, reinforcing the network’s utility in decentralized applications. Nonetheless, chainlink’s short-term price pressure persists amid cautious market sentiment.

Experts highlight that the recent profit-taking during minor rallies could signify weak bullish conviction, potentially leading to extended downward pressure if key support levels—such as $15.45—fail to hold.

The price uptick temporarily improved net transfer volume from negative to neutral but also exposed underlying selling dynamics as holders capitalized on short-term gains. Rising exchange inflows during the bounce imply liquidations rather than sustained buying momentum.

This pattern fits a broader trend seen in the cryptocurrency sector, where macroeconomic factors dampen sentiment despite solid project fundamentals. Chainlink’s role in providing secure data oracles remains vital, but a sustained recovery depends on breaking resistance levels and improved market conditions.

—

### Key Takeaways

– **Accumulation Signal:** Withdrawal of over 63 million LINK tokens signals strong demand and holder confidence, supported by data from Ali Martinez and Glassnode.

– **Bearish Price Pressure:** LINK’s 30.1% price decline since October, coupled with profit-taking during rallies, indicates ongoing short-term market challenges.

– **Recovery Outlook:** Monitoring of $15.45 support is critical—breaking this level could extend the downtrend, while Chainlink’s growing partnerships and reserve accumulation offer long-term bullish potential.

—

### Conclusion

The recent withdrawal of over 63 million Chainlink LINK tokens from exchanges highlights a significant accumulation phase amid a challenging market environment. Positive on-chain indicators such as reserve growth and community sentiment contrast with bearish price action and profit-taking behavior.

Chainlink’s expanding oracle network and increasing integration with decentralized finance platforms provide strong fundamentals. However, near-term recovery depends on maintaining critical support levels and reducing selling pressure.

Investors interested in Chainlink should closely monitor these on-chain trends and price dynamics to identify emerging opportunities within the evolving crypto landscape.

—

### Frequently Asked Questions

**Q: What does the withdrawal of 63 million Chainlink LINK tokens from exchanges mean for investors?**

A: This withdrawal typically signals accumulation by long-term holders, reducing the selling pressure on exchanges and indicating confidence in Chainlink’s utility. It could eventually lead to a supply squeeze if demand rises.

**Q: Why is Chainlink’s price declining despite positive on-chain withdrawal activity?**

A: LINK’s price decline stems from broader market bearishness and profit-taking during short-term rallies. On-chain data shows that despite accumulation, exchange inflows spiked during price rallies, indicating weak buying conviction and prolonging the downtrend.

—

Stay informed on Chainlink developments and overall crypto trends to navigate the market effectively.

https://bitcoinethereumnews.com/tech/chainlinks-63-million-link-withdrawal-hints-at-accumulation-despite-uncertain-recovery/