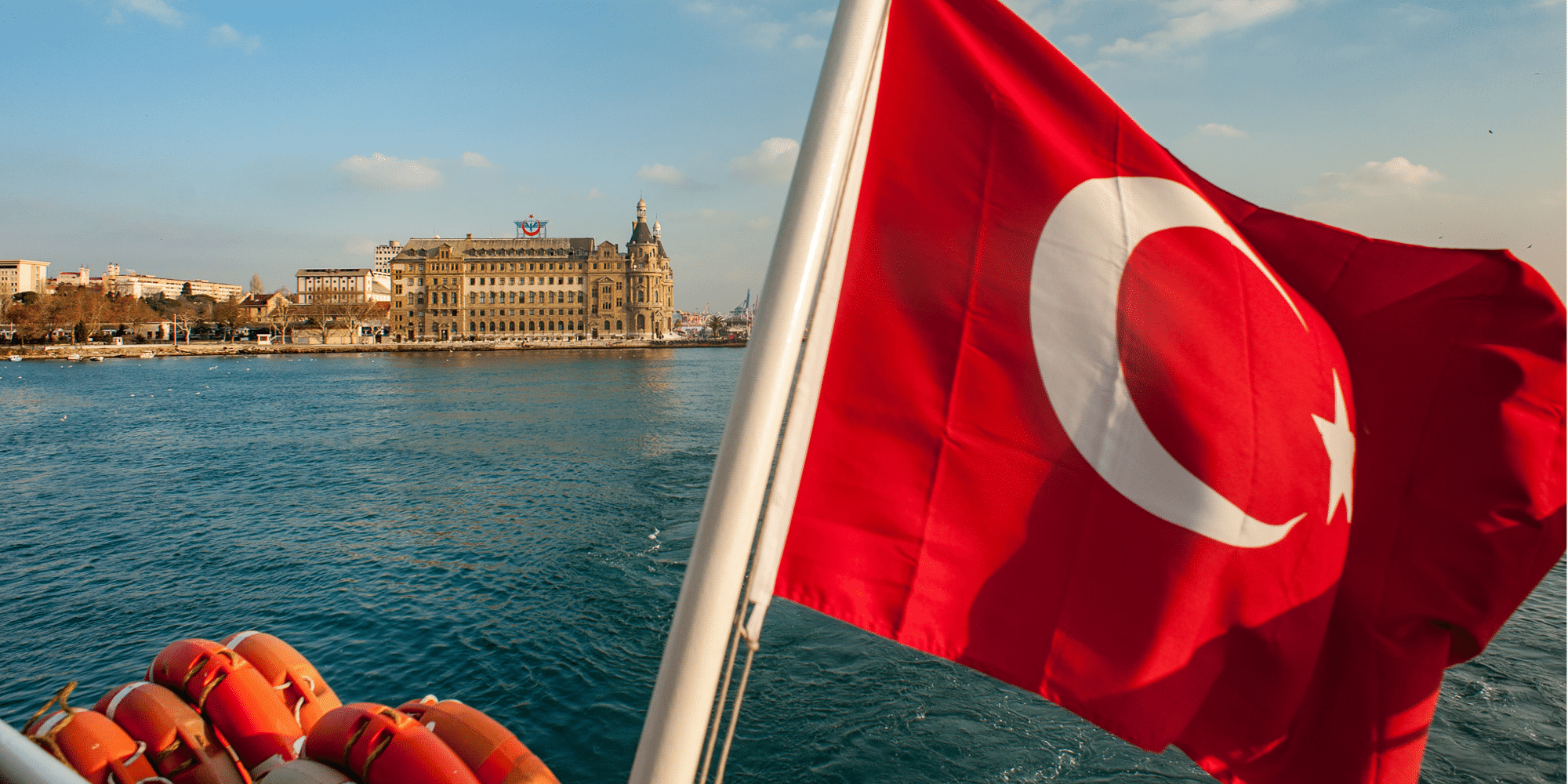

**Turkey Leads MENA Crypto Market with $200 Billion in Transactions in 2025**

Turkey has emerged as the largest cryptocurrency market in the Middle East and North Africa (MENA) region, recording a staggering $200 billion in annual crypto transactions in 2025. This significant milestone highlights Turkey’s dominant position in the regional crypto space, far surpassing other countries such as the UAE, which recorded $53 billion during the same period.

**Shift from Stablecoins to Altcoins**

Recent data from Chainalysis reveals a notable shift in Turkey’s crypto trading patterns, with a growing preference for altcoins over stablecoins. By mid-2025, Turkey’s 31-day moving average for altcoin trading surged to $240 million, up sharply from $50 million in late 2024. Conversely, stablecoin trading volume plummeted from over $200 million to just $70 million.

This transition signals that traders are moving away from safer assets toward riskier, potentially higher-yielding tokens. Chainalysis suggests that this change coincides with broader regional economic challenges, as investors seek greater returns amid financial instability.

**Institutional Activity Rises While Retail Participation Declines**

The cryptocurrency market in Turkey is increasingly dominated by institutional investors. The latest report indicates that large-scale institutional transactions have grown, while retail trading activity has diminished.

Economic hardships, including persistent inflation and currency instability, have made crypto more attractive to wealthier investors who have greater access to capital. Meanwhile, everyday Turkish citizens face reduced capacity to engage in the market, with retail participation declining as economic pressures mount.

Chainalysis notes, “Turkey’s economic challenges may be reducing the capacity of everyday Turkish citizens to participate.” This contrasts with countries such as the United Arab Emirates, where crypto usage is expanding beyond investment to practical applications like payments.

**MENA Region’s Growth Trails Behind Other Markets**

Despite Turkey’s leading position, the overall growth of the MENA crypto market remains modest compared to other regions. The region experienced a 33% year-over-year increase in crypto use, trailing behind Asia-Pacific’s 69%, Latin America’s 63%, and other areas like Sub-Saharan Africa and North America, which saw growth rates exceeding 50%.

While Turkey’s strong trading volumes boost the MENA region’s global standing, many neighboring countries—including Egypt, Jordan, and Saudi Arabia—continue to register much lower crypto activity. Additionally, crypto adoption in MENA is generally more speculative and less diversified in practical uses.

**Economic Pressures Drive High-Risk Trading Behavior**

Turkey’s ongoing economic struggles, marked by high inflation and a weakening currency, are key factors shaping the country’s unique crypto market dynamics. Many institutional players appear to be using cryptocurrency as a store of value or hedge against the declining Turkish lira.

However, the sharp rise in altcoin trading reflects an increased appetite for risk among traders. Chainalysis describes this as “desperate yield-seeking behavior,” underscoring that many participants are venturing into volatile assets in pursuit of quick returns.

While this strategy may yield short-term gains for some, it raises concerns over market stability and sustainability. The growing concentration in high-risk altcoins increases vulnerability to sudden price swings and shifts in investor sentiment.

—

Turkey’s crypto market in 2025 is a complex mix of significant volume growth, institutional dominance, and risky trading. As economic challenges persist, the future of crypto adoption in Turkey and the wider MENA region remains uncertain, with tension between speculative enthusiasm and practical usability shaping the landscape ahead.

https://coincentral.com/turkeys-crypto-market-grows-to-200b-with-altcoins-driving-volume/